Growing older brings wisdom, experience, and a deeper appreciation of life. But it also brings new responsibilities—especially when it comes to health. As we age, medical needs tend to increase. That’s why having health insurance in your senior years is not just helpful—it’s essential.

Health insurance provides financial protection, peace of mind, and access to quality medical care. In this article, we explore why every senior citizen should consider a good health insurance plan, and how to choose the right one.

Health Expenses Rise With Age

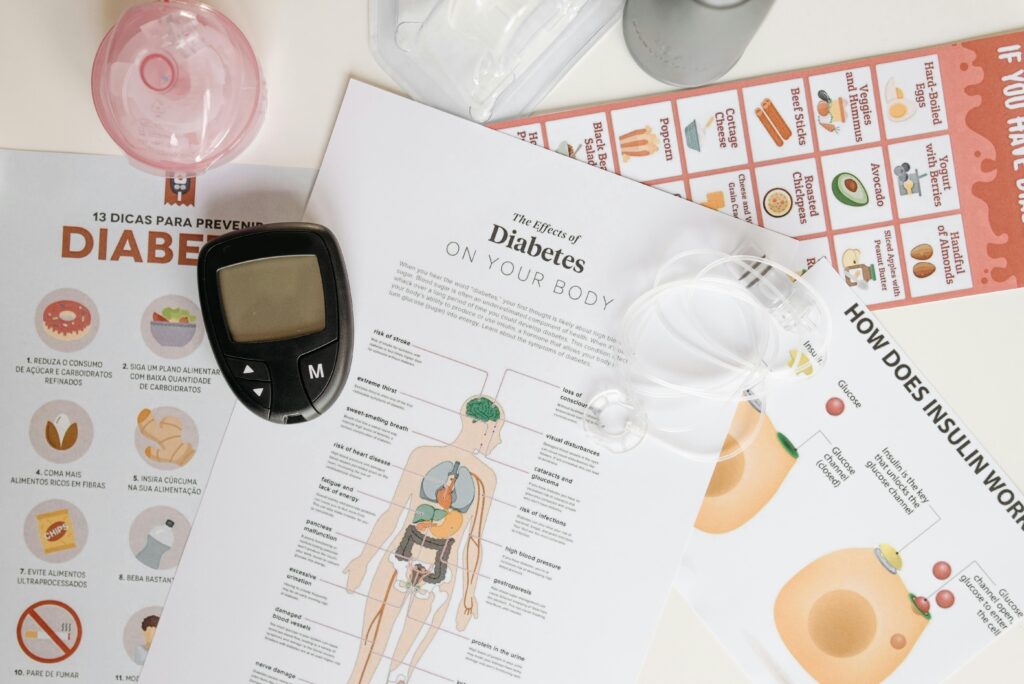

With age, the body undergoes natural changes. Some people may develop chronic conditions like diabetes, high blood pressure, arthritis, or heart disease. Others may require regular check-ups, surgeries, or hospitalization due to sudden illness or injury.

Unfortunately, medical costs are rising steadily. A short hospital stay or an emergency surgery can wipe out a significant portion of your savings. Health insurance can ease this burden by covering most of these expenses—so you don’t have to dip into your retirement funds.

Don’t Rely Only on Family Support

Many older adults expect their children or relatives to take care of their healthcare costs. While most families are happy to help, financial pressures can make this difficult. Having your own insurance ensures that you are not placing a heavy burden on your loved ones.

Being financially prepared also gives you more independence. It allows you to make decisions based on your needs—not just what others can afford.

Peace of Mind During Emergencies

One of the greatest benefits of health insurance is peace of mind. Knowing that you are covered during a health crisis removes a lot of stress.

Whether it’s a heart condition, a sudden fall, or a scheduled knee replacement surgery, a good policy will help cover:

- Hospital room charges

- Doctor’s fees

- Diagnostic tests and scans

- Medicines and treatment

- Post-hospital recovery or daycare procedures

This coverage ensures that you can focus on getting better, instead of worrying about bills.

Access to Better Healthcare

With insurance, you can access quality healthcare facilities, both in private and public hospitals. Many insurance providers also offer cashless hospitalization—meaning you don’t have to pay upfront and wait for a refund. You just present your insurance card, and the hospital bills are settled directly with the insurer.

Some policies even cover annual health check-ups, specialist consultations, and home healthcare, which can be especially helpful for elderly patients.

Plans Designed for Seniors

Today, several insurers offer policies designed specifically for older adults. These senior citizen health insurance plans often have:

- Higher entry age limits (some even up to 80 or more)

- Lifelong renewability

- Coverage for pre-existing illnesses after a waiting period

- Options for individual or family floater plans

While the premiums may be higher than younger age groups, the benefits are well worth the cost.

It’s a good idea to compare plans before you buy. Look for coverage, premium amount, network hospitals, claim process, and what is not covered (exclusions). Ask a family member or financial advisor to help you go through the options.

What Happens If You Delay?

The longer you wait to buy insurance, the fewer options you may have. After a certain age, some insurers may not accept new applicants. Others may add strict conditions or long waiting periods.

Also, health conditions that develop before you buy a plan are called pre-existing illnesses. These may not be covered immediately. So, the earlier you get insured, the better your chances of being covered when you need it most.

Real-Life Example

Mr. Suresh, a 67-year-old retired schoolteacher, had never taken health insurance during his working years. At 70, he had to undergo a gallbladder surgery. The cost was over ₹2 lakh. Since he had no insurance, he had to break his fixed deposit.

Now, his son has helped him get a senior citizen health plan. While there’s a waiting period for certain conditions, any future hospital visits will be easier to manage financially.

Tips for Choosing the Right Policy

Here are a few things to keep in mind:

- Entry age: Check if you’re eligible based on your current age.

- Sum insured: Choose a coverage amount that matches possible hospital expenses in your area.

- Waiting period: See how long you need to wait before pre-existing conditions are covered.

- Cashless hospitals: Look at the list of network hospitals near you.

- Premium: Make sure it fits your budget, but don’t compromise on coverage.

- Renewability: Pick a plan that offers lifelong renewal.

Involving Your Family in the Process

Buying health insurance is an important decision. It’s best made with family. Your children or caregivers can help compare policies, explain technical terms, and guide you through the paperwork.

Also, keep your policy documents in a safe and easily accessible place. Make sure someone in the family knows the details, so that in an emergency, help is quick.

Final Thoughts

Health insurance is not just a policy—it is a safety net. It protects your savings, reduces your stress, and gives you access to better healthcare. In your senior years, it is one of the most valuable things you can have.

It’s never too late to secure your health and your peace of mind. Talk to a trusted advisor or family member today, and choose a plan that suits your needs.

💬 Stay Connected

If you found this article helpful, please share it with your friends and family. Let’s ensure every senior gets the care and support they deserve.

👉 Follow our blog for weekly updates on health, wealth, and happiness after 60.

📢 Share this post to help others plan better for their golden years.