As India continues to prioritize the welfare of its aging population, the Union Budget 2025 brings several tax benefits aimed at easing the financial burden on senior citizens. With rising healthcare costs and inflation, these tax reliefs play a crucial role in ensuring financial security for older adults.

1. Increased Basic Exemption Limit

For senior citizens (aged 60 and above), the basic exemption limit has been raised to ₹3.5 lakh from the previous ₹3 lakh. Super senior citizens (aged 80 and above) continue to enjoy a higher exemption limit of ₹5 lakh. This means income up to this threshold is tax-free, providing relief to retirees with fixed incomes.

2. Higher Standard Deduction

The standard deduction for pensioners has been increased to ₹75,000 from ₹50,000, allowing more tax savings for retirees who depend on pension income.

3. No TDS on Senior Citizens’ Fixed Deposits

Banks and post offices will now apply a zero TDS (Tax Deducted at Source) policy on interest income up to ₹75,000 per year for senior citizens. This ensures that retirees do not face cash flow issues due to unnecessary tax deductions.

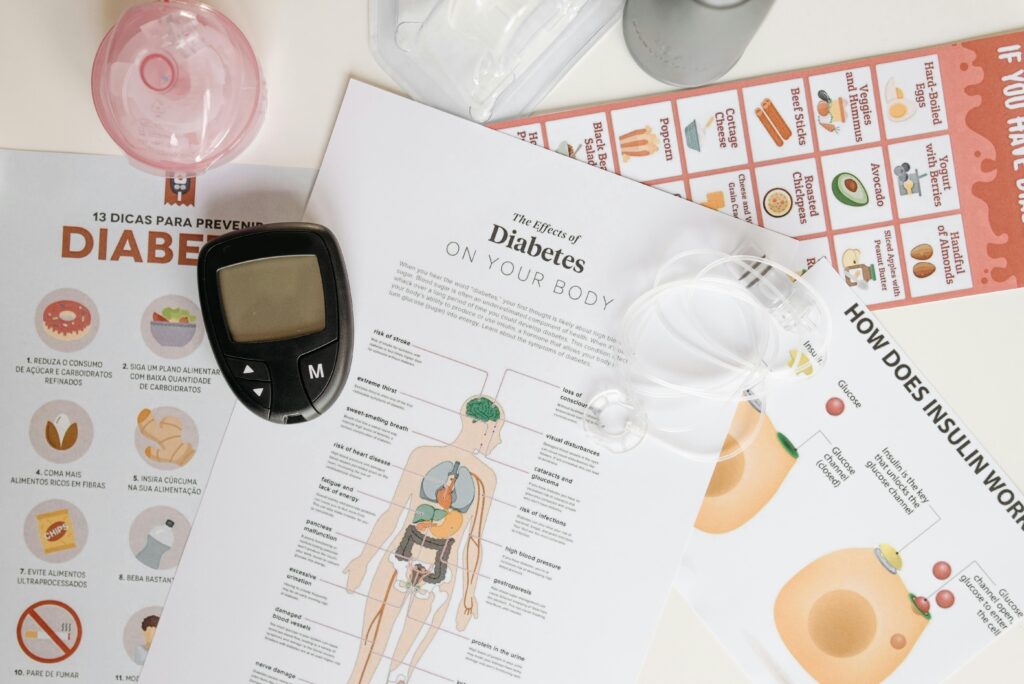

4. Increased Section 80D Deduction for Health Insurance

With rising healthcare expenses, the deduction under Section 80D for senior citizens’ health insurance premiums has been increased from ₹50,000 to ₹75,000. Additionally, medical expenses for those without insurance can now be claimed up to ₹1 lakh.

5. Higher Tax-Free Income from Reverse Mortgage Schemes

Senior citizens opting for reverse mortgage schemes will now enjoy a higher tax-free income limit, ensuring that they can use their property as a financial asset without additional tax burdens.

6. Increased Exemption under Section 80TTB

Interest income from bank deposits, post office schemes, and other investments under Section 80TTB now has a higher exemption limit of ₹75,000, up from ₹50,000. This benefits retirees who rely on fixed deposits and other savings for their monthly expenses.

7. Special Tax Benefits for Senior Citizen-Friendly Investment Schemes

The Senior Citizens Savings Scheme (SCSS) and the Pradhan Mantri Vaya Vandana Yojana (PMVVY) now offer higher investment limits and tax-free returns, making them attractive options for retirees.

8. Easier Tax Filing and Compliance

The government has also introduced simplified tax return filing processes for senior citizens, including auto-populated returns and fewer document requirements, reducing the hassle of compliance.

Final Thoughts

The Union Budget 2025 brings welcome tax relief for senior citizens, recognizing their financial challenges and offering them greater security in their retirement years. With higher exemptions, increased deductions, and reduced compliance burdens, these measures aim to support the well-being of older adults and help them enjoy a financially stable life.

For personalized tax planning, senior citizens should consult with a financial advisor to make the most of these benefits.